Living: personal care, bank fees, salon and spa services, dry cleaning, pet costs, memberships (fitness, clubs, associations) Groceries: food, baby needs, household supplies, toiletries

Household: furnace, water tank, roof and gutters, decor, upgrades, storage locker, gardening, cleaning services, outdoor equipment and maintenance Utilities: phone/cell, cable/internet, gas, hydro, security Housing: mortgage, rent, strata fees, house insurance, property taxes View a sample of a completed tracker (from the previous version of our Monthly Expenses Tracker).Įxpense Categories – Know Where Your Money is Going This becomes the cash balance for the next week. If there’s a surplus, you should have money in your wallet or bank account. Total all columns and subtract actual expenses from actual income.On these pages, keep track of seasonal expenses rather than recording on your weekly pages. You also need to record weekly savings amounts on pages 14 – 15 of the Expense Tracker.You may want to track coffees, dining out, or fuel separately. You can then use the blank columns to create your own categories. List the dates down the left side and record actual money spent each day.You should also list any income you may expect to receive during each week. Record cash balances on hand or in your bank account.For example, a 7 day tracking period would be March 30th to April 5th. For each week, record dates you are tracking.The expense categories listed further below and on page 1 of the Expense Tracker will help you decide which expenses to record where.Open a copy of our Monthly Expense Tracker.If you find you’ve got more money going out than what you’ve got coming in, you can use the planner to identify where you could be making savings.

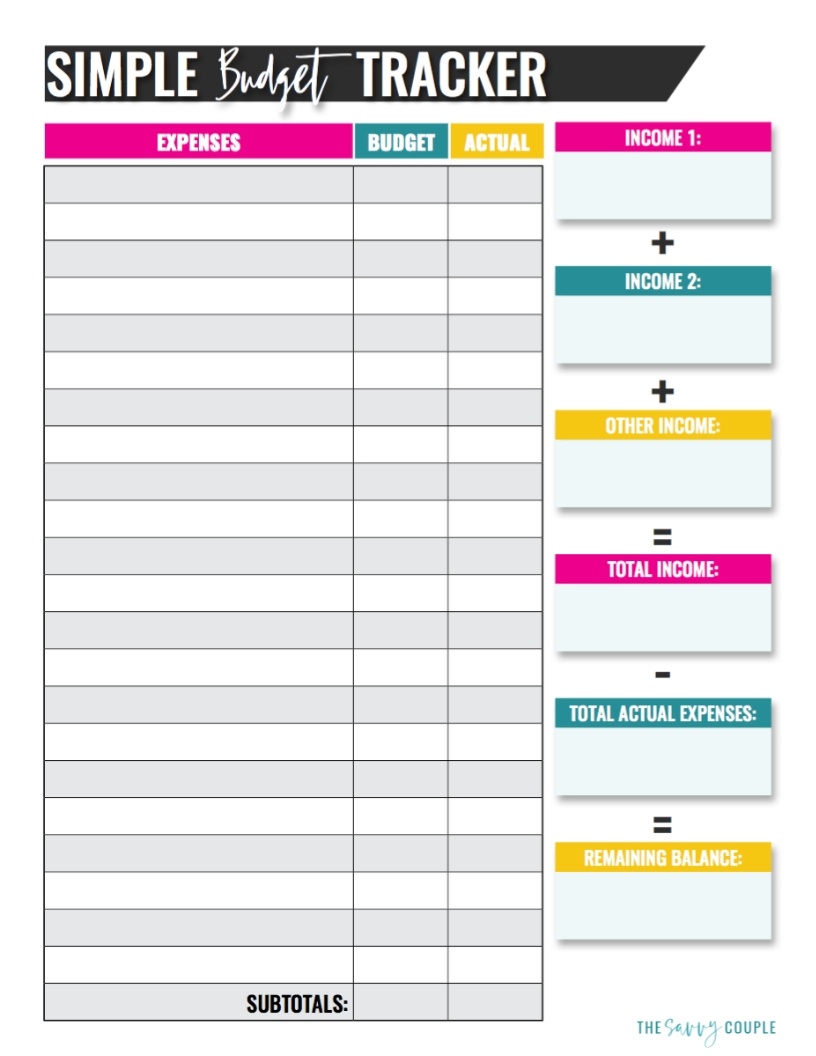

Once you’ve included all your incomings and expenses, the planner can add them up and let you know exactly how much money you’ve got left over once all your expenses are covered. Using a budget planner can take the heavy lifting out of doing the maths. That means it might prompt you to include some you could otherwise have forgotten. The good thing about using a budget planner is it includes a detailed list of possible expenses. Some of these might seem obvious, such as your mortgage or rent payments as well as electricity and other utilities, but others might take a bit more thinking about, such as how much you spend on going out, or lunch at work for example. The next step is to include all your outgoings.

To make it easier, you can select on the frequency you get paid (e.g. The most obvious stream of income is likely to be your salary or wages. Using a budget planner to work out your budgetĪ budget planner tool is essentially an online calculator that can be used to run the sums on your incomings and expenses.įirst up, the budget planner has fields to enter in your income. Not only is having a budget is a good way of finding out if you’re spending more or less money than you’ve got coming in, it’s also a good way of staying on track of your bills, as well as setting aside money to work towards savings goals. Using a budget planner can take the heavy lifting out of sorting out your budget – you simply enter in the amount of money you’ve got coming in (such as your salary) and then put in the expenses you’ve got coming out.

0 kommentar(er)

0 kommentar(er)